[This article is from the Wall Street Journal on November 20, 2024 and is available HERE on their site.)

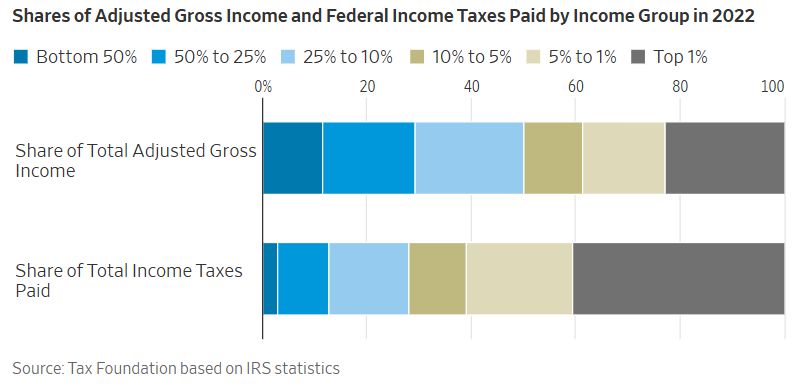

Here’s a statistic to remember next year, as Congress debates extending President Trump’s 2017 tax cuts: The top 1% of income-tax filers provided 40.4% of the revenue in 2022, according to recently released IRS data. The top 10% of filers carried 72% of the tax burden. Self-styled progressives will never admit it, but U.S. income taxes are already highly progressive.

These figures are from the Tax Foundation’s analysis of the IRS data, which is worth a read. But allow us to highlight a few points, starting with why this matters for the political debate. The GOP’s 2017 law lowered tax rates on people across the income spectrum, and those changes expire at the end of 2025. Extending today’s top marginal rate on high earners, 37%, will be contentious. Democrats will want to let it revert to the old 39.6%. Mr. Trump, scrounging to pay for other priorities, might go along.